Report authored by: Shaheer Burney, PhD & Amber Remble, PhD. Department of Agricultural Economics, University of Wisconsin, River Falls.

Report authored by: Shaheer Burney, PhD & Amber Remble, PhD. Department of Agricultural Economics, University of Wisconsin, River Falls.

To get this report as a downloadable PDF, CLICK HERE

Funding for this study was provided by the Renk Agribusiness Institute at the University of Wisconsin-Madison. The authors would like to thank the growers, processors, and extension personnel for sharing important information for this study. Special thanks to Liz Binversie and Dr. Shelby Ellison for assisting with data collection.

Statements and estimates in this report are based on a number of data sources, including the data provided by the 2018 Wisconsin DATCP Survey of 143 growers and processors, the 2019 Wisconsin Hemp Marketing Survey of 140 growers and processors, and information gathered directly from hemp growers, processors, and extension educators through phone calls and farm visits. As such, the content of this report is based on both analytical survey data and anecdotal information.

Due to the infancy of the Wisconsin hemp industry and the nature of hemp farming, there is wide variation in estimates of yields, costs, prices, and returns. As a result, these estimates should be considered a broad reflection of the hemp industry instead of standards for Wisconsin or recommendations for production. Estimates will depend on numerous factors such as production, processing, and marketing methods, growing experience, cost of inputs, etc.

RESPONDENT CHARACTERISTICS

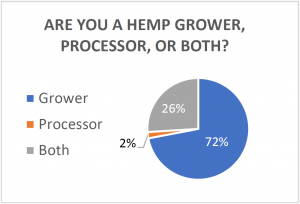

The 2019 Wisconsin Hemp Marketing Survey was conducted during the 2019 growing season, in July 2019, but largely reflects dynamics of the industry in 2018, Wisconsin’s first year of legalized hemp production. Responses were collected from growers and processors through an online survey instrument, in-person conversations, and emails. Below are some summary characteristics of the 2019 survey respondents and their responses.

ECONOMIC DATA

Estimates in this section are derived primarily from the 2018 Wisconsin DATCP Survey and the 2019 Wisconsin Hemp Marketing Survey. Other sources used are noted where applicable.

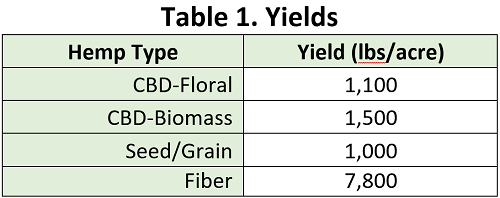

Data for yields is obtained from various sources, including 2018 & 2019 surveys, newspaper articles, conversations with WI hemp farmers, enterprise budgets from other states, etc. Except for CBD-Floral yields, which are Wisconsin-specific, all other measures are considered industry averages.

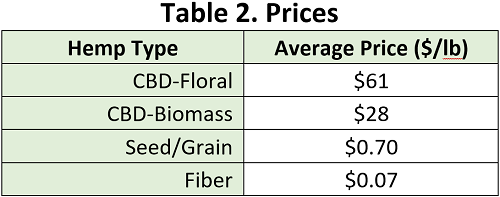

Prices of CBD hemp is based on dry matter sold for CBD extraction, assuming 10% CBD per pound. Prices of CBD-Floral are estimated using data from the WI Hemp Marketing Survey, prices of CBD-Biomass data are obtained from www.hempbenchmarks.com, prices of Seed/Grain and Fiber are obtained from the Congressional Research Service. Except for CBD-Floral prices, which are Wisconsin-specific, all other measures are considered industry averages.

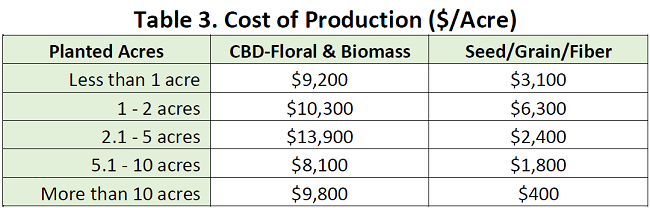

Estimates include both variable costs (e.g., seeds, transplants, hired labor, fertilizer, etc.) and fixed costs (e.g., purchases of equipment, rent, registration fees, etc.)

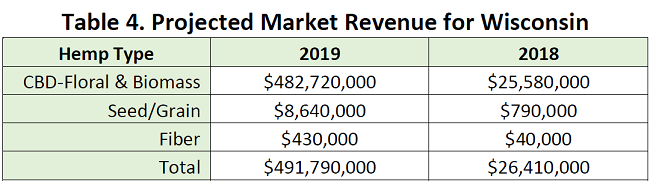

Estimates for 2019 revenue are projected using industry averages for yields, prices, and projected 2019 acreage, assuming all planted acres are harvested and all the production sold at the reported prices.

CONSIDERATIONS FOR GROWERS

In this section, we outline some common issues faced by Wisconsin producers during the first two years of growing hemp. Some of the common issues reported by growers include weather, weeds/pests/mold, seeds, testing, selling, harvest, drying, networking, fees (registration, licensing, testing), and labor. Further, we provide insights that first-time growers may find helpful in navigating through the growing process.

Networking

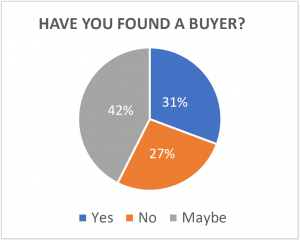

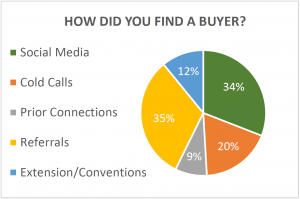

A major hurdle for growers was finding buyers for their product. Several growers were unable to sell their product or were not satisfied with the selling arrangements they received due to lack of networking opportunities. Among challenges with networking, growers also mentioned not having access to a community of growers and processors to discuss different facets of growing hemp or finding answers to technical questions. Several growers relied on social media and online forums to develop their network but mentioned the need for organizing a cohesive network for growers, processors, and retailers. Growers looking for networking opportunities can refer to the University of Wisconsin-Extension’s Buyer-Seller Directory, which provides a meeting place for industrial hemp buyers and sellers.

Weather

Weather-related impediments were the largest concern among growers during the 2018 & 2019 growing years. Heavy and frequent rainfall, especially around harvest time, led to destruction of crops and removal of storm-damaged plants led to delayed harvest. Damp conditions also delayed the drying process and led to the appearance of Botrytis, also known as Gray Mold. Persistent rainfall made it difficult for many growers to physically harvest the crop and considerably shortened the window for harvesting. Weed pressure was one of the main factors behind the destruction of some crops. Some growers also faced delays and crop damage due to frost. Given the large amount of labor involved in planting and harvesting hemp, adverse weather can be a big obstacle for growers.

Seed

Numerous growers had difficulty acquiring seed for their crop. Finding certified and reputable seed banks, transportation of seed, finding mold-resistant seed, high cost of seed, and lack of confidence in types of seeds available were some common seed-related challenges growers faced in both 2018 & 2019. Some growers purchased seeds from outside of Wisconsin. While growers are permitted to purchase seed from anywhere, only Wisconsin-licensed growers are allowed to sell seed in the state. The Wisconsin DATCP provides a list of licensed businesses selling seeds and transplants for cultivation. It should be noted that, according to Wisconsin law, there is no penalty for buying seeds from unlicensed sellers. Detailed state laws on buying seed can be found on the Wisconsin DATCP Industrial Hemp Seed and Transplants webpage.

Labor

Planting and harvesting hemp are very labor intensive. About half of Wisconsin growers who provided comments on their harvest mentioned manual labor requirements as a major consideration in growing hemp. However, labor impediments are a function of farm size. A greater share of small-scale (2 acres or less) growers stated labor as an impediment relative to growers with larger operations (greater than 2 acres). Some growers faced delays in harvesting due to their inability to obtain sufficient labor in time. In addition, over 80% of growers harvested their product using hand tools and many growers planted by hand. This is not surprising given that a large share of growers cultivated on a small scale (2 acres or less).

Equipment

A vast majority of growers planted and harvested their crop by hand, either using manual tools or power tools. Planting equipment included shovels, augers, manual corn planters, tillers, pipe planters, and rototillers. Several growers germinated seeds in a greenhouse before transplanting to the field. Most harvesting for CBD hemp was done by hand, partly because harvesting by hand minimizes the damage potential to the hemp flower. Common hand tools for harvesting included pruning shears, loppers, axes, clippers, and handsaws. Power tools included chainsaw and reciprocating saw (or Sawzall).

Larger operations were able to mechanize the planting and harvesting process and did not face labor bottlenecks. Some large growers planted with a mechanized grain drill. Harvesting equipment used by large farms included combines, several with stripper heads and grain heads. In addition to harvesting the plant, stripping flowers can involve a considerable amount of hand labor. Stripping was generally done by hand, even by some farmers who used combines for harvesting. Growers mentioned the need for purchasing hemp-specific trimming equipment, building greenhouses for seed germination, constructing deer fencing, and a few purchased additional land for growing hemp.

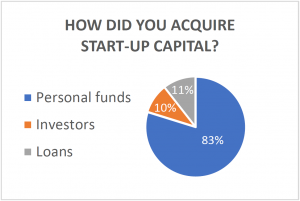

Financing

A common concern among both, growers and processors, is lack of financial resources. Anecdotally, securing operating loans is difficult due the uncertainty regarding federal regulations on industrial hemp. Most growers and processors financed the startup cost of their operation from personal sources. Some were able to acquire a loan by offering equipment as collateral, as long as the equipment was not specific to hemp. Although the 2018 Farm Bill has legalized the cultivation, processing and marketing of industrial hemp, banks have been hesitant to take on the investment into these operations due to the infancy of the market and the existing uncertainties about the legal status of various cannabinoid products. The interim final rule establishing domestic hemp production regulation released by the USDA in October 2019 is expected to ease this hesitation.

PROCESSORS

The goal of this study was to explore the experience of industrial hemp growers in Wisconsin. The subsequent phase in the supply chain is processing the plant to transform it into a marketable product. Both the 2018 and 2019 surveys suggest that there is a bottleneck in this phase of the supply chain. There are not as many processors as growers in the state of Wisconsin and first-time processors operating in the state have limited processing capacity. Both of these facts can be attributed to the high investment costs required for processing equipment. Processors expressed concerns on the immaturity of the market and the difficulty in establishing relationships with growers as well as having access to consistent and reliable payment methods and funding. There are large processors throughout the state that do not solely focus on hemp but are nonetheless offering processing services. The climate of the processing phase goes beyond the scope of our study at this current time, but its crucial role is undeniable.

Several respondents stated that they grew and processed industrial hemp, most of who grew CBD hemp and processed CBD products. Some of these operators are solely processing their hemp crop while some have attempted to make contacts with other growers via social media and other networks. Of the few that stated their pricing arrangements with growers, most stated they had arranged a profit split on the final product. Most of the grower/processors self-funded their processing equipment purchases.

RULES & REGULATIONS

For more information on the USDA’s Agricultural Marketing Service (AMS) Rules and Regulations and the Establishment of a Domestic Hemp Production Program, visit https://www.ams.usda.gov/rules-regulations/hemp.